Turning a Single-Family Home Into 22 Multifamily Units

Client Goal:

Our buyer—referred by a trusted partner—wanted to sell a single-family home he had built and exchange the proceeds into as much multifamily unit count as possible. He had limited multifamily experience and had never completed a 1031 exchange. The priority: maximize units, maximize long-term upside, minimize risk.

Challenges:

Buyer had never executed a 1031 exchange

Limited familiarity with multifamily underwriting

Limited quality listing inventory in the Portland MSA

Few deals available in the price range

Time-sensitive 1031 timelines added pressure to get it right

Actions Taken:

Strategic Underwriting & Market Guidance

We evaluated multiple deals to identify assets with true operational upside—not just marketing fluff. We led value analysis, rent surveys, and financing strategy to align each option with the buyer's exchange requirements.

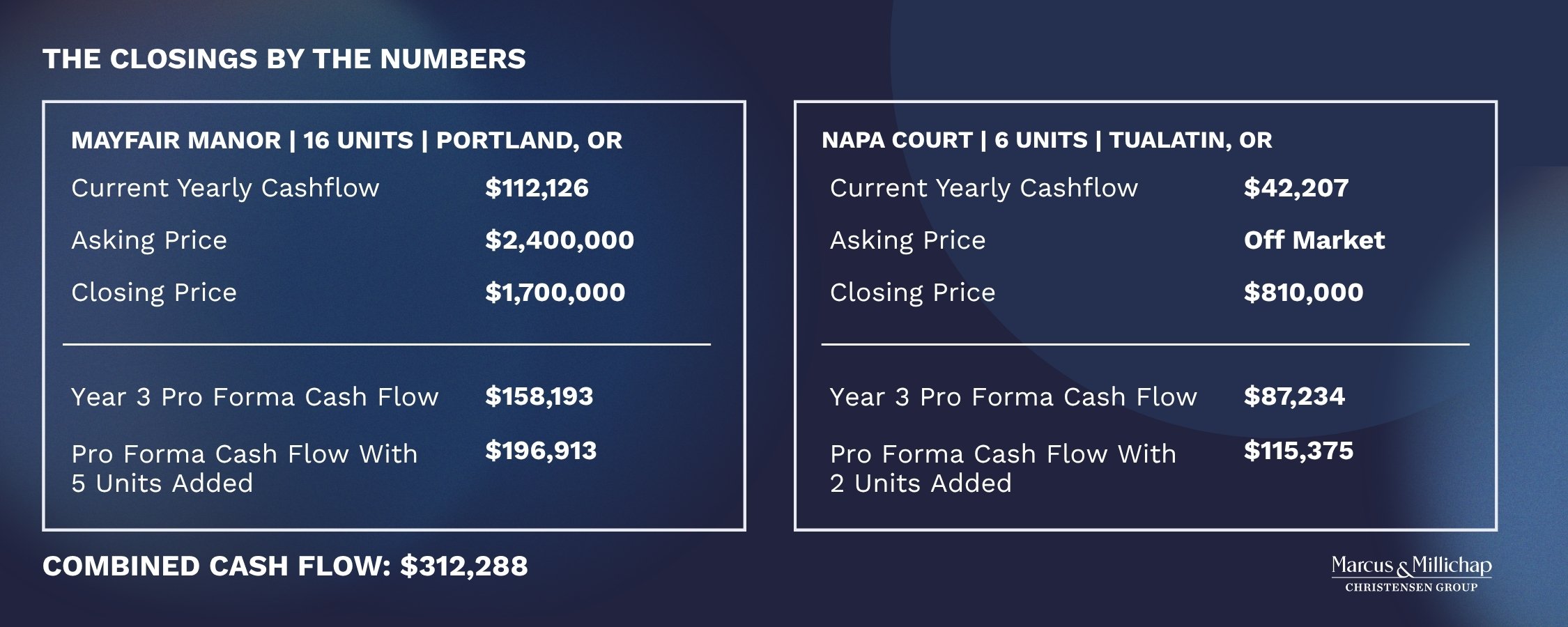

Identifying the Winner — 16 Units in Portland

The property had been held by the same local family for nearly 30 years—immaculate condition, but rents were 35% below market. Because the in-place cap rate was low, the listing sat longer than expected. We leveraged that gap to negotiate a $700,000 discount from list price by presenting a case built around achieving market rents supported by our comps and NOI analysis.

Finding Hidden Upside On-Site

During inspections, we uncovered a large maintenance room with a sliding glass door adjacent to the laundry/storage area. This layout made a clear pathway to convert the space into a new one-bedroom unit—an unrepresented value-add opportunity that materially increased returns. This was a high-impact win for our buyer and a perfect example of why on-site diligence matters.

Identifying Additional Exchange Options

Because we secured such compelling pricing on the 16-unit asset, the buyer had remaining proceeds in his exchange. We immediately connected him with one of our sellers—an owner facing major capital repair needs on a distressed six-plex in Tualatin. They were stuck between costly renovation or selling in a declining environment.

Negotiation Across Both Sides

The seller valued certainty over investing additional capital. The buyer valued upside and was willing to take on improvements. The parties aligned at $135,000 per unit, giving the buyer strong renovation upside while allowing the seller to exit cleanly.

Financing Solutions Secured

Tammy Linden with MMCC delivered conventional bank financing on both acquisitions, giving the buyer stability and long-term runway.

Results:

- Buyer converted single-family equity into 22 multifamily units

- $700,000 discount secured on 16-unit Portland deal

- Additional value-add units created via layout optimization

- Off-market six-plex secured at $135K per door in Tualatin, OR

- Buyer positioned for long-term growth with renovation upside

- Seamless completion of first-ever 1031 exchange

Why This Matters:

In a market where many buyers are paralyzed by noise, this strategy proves that opportunity exists for investors who act decisively and partner with advisors who can interpret the true story beneath the numbers.

Stay tuned—video breakdown coming later this week.