Beyond the Cap Rate 10.14.25

The Tide Is Turning in Commercial Real Estate — and the Pacific Northwest Is Well-Positioned

After two years of sluggish transaction volume, signs of life are reemerging in commercial real estate.

In the first half of 2025, investment activity remained about 10–15% below the 2014–2019 average, but momentum is shifting. By the third quarter, deal flow across multiple property types — particularly multifamily — began to accelerate.

The reasons point to a structural, rather than cyclical, recovery.

Below are four key forces behind the comeback — and what they mean for apartment investors in the Pacific Northwest.

1. Equity Capital Is Flowing Back

Private investors are once again the dominant force in the market, accounting for 59% of all CRE transactions in the first half of 2025.

Fundraising volumes tell a similar story: investment funds raised roughly $30 billion per quarter, slightly above the 10-year average of $28 billion. While each fund is raising less individually than during prior peaks, the overall activity level indicates renewed confidence and a broader base of capital returning to the field.

For multifamily owners and developers, that means more competition for stabilized assets — and a deeper pool of equity for value-add or recapitalization opportunities.

2. Debt Capital Is Loosening

After an extended pullback, banks are re-entering the CRE lending market.

Loan-to-value ratios are trending upward — around 62% for multifamily and 56% for other commercial assets — suggesting that lenders are gradually easing underwriting standards as market risk stabilizes.

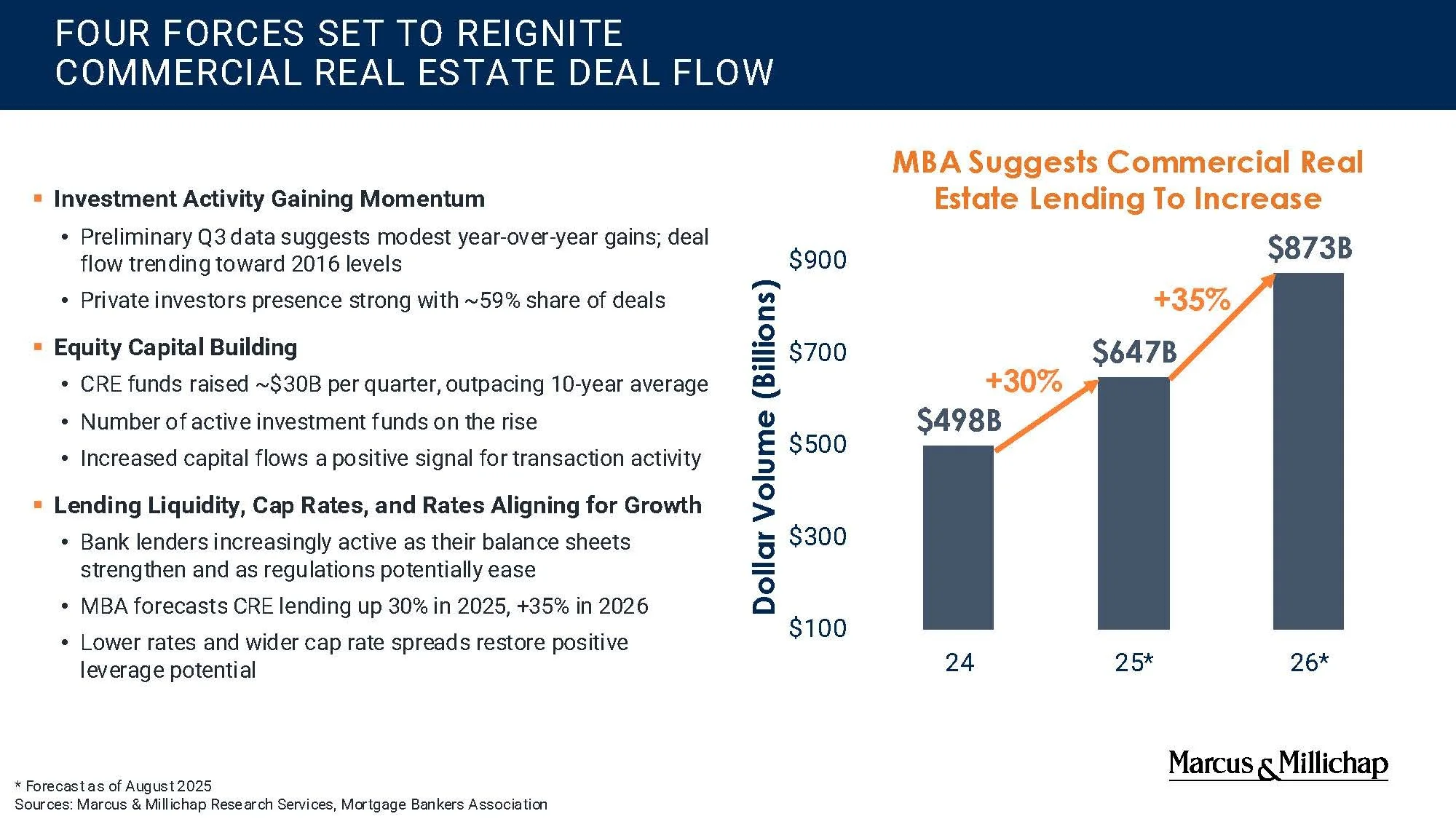

The Mortgage Bankers Association forecasts CRE lending to rise roughly 30% in 2025 and another 35% in 2026, signaling that liquidity is returning to the debt markets.

This matters most for transactions that stalled in 2023–2024 when leverage evaporated. As debt availability improves, more deals pencil.

3. Interest Rates Are Stabilizing — and Spreads Are Expanding

Cap rates have expanded by 80–120 basis points since 2022, while interest rates have begun to taper.

That shift is restoring one of the essential ingredients of a healthy investment market: positive leverage.

With yield spreads widening again, buyers can once more underwrite deals where income growth, not just speculation, drives return.

In short, the math is working again — and that changes everything for transaction velocity.

4. Debt Pricing and Property Class Dynamics Are Favorable

Debt is still expensive compared to 2019, but it’s rational again.

Agency financing for multifamily assets now sits in the low-5% range, while other CRE debt has landed in the low- to mid-6% range.

These rates, paired with the return of equity and loosening leverage, are bringing buyers and sellers closer to alignment. When both sides can agree on value, deals happen.

A Quiet Tailwind: Limited New Supply

Construction pipelines have slowed materially across most CRE asset classes.

That’s bad news for contractors — but excellent news for investors holding or acquiring existing properties.

Fewer new deliveries mean tighter long-term fundamentals, less competition for tenants, and greater potential for rent growth once the economy stabilizes.

What It Means for Pacific Northwest Investors

The Pacific Northwest tends to lag national CRE cycles on the way down — and lead them on the way back up.

With borrowing conditions improving, new construction slowing, and institutional capital returning to secondary markets, investors positioned in Oregon and Washington are poised to benefit disproportionately from the next phase of recovery.

As liquidity and confidence return, owners who understand their operational performance today will be best positioned to capture tomorrow’s pricing.

In Short

The forces that slowed CRE deal flow — high rates, tight capital, and valuation mismatches — are finally easing.

And while challenges remain, the balance of indicators now points to an accelerating transaction market in 2025 and beyond.

For investors, that’s not a signal to wait — it’s a cue to prepare.

Georgie Christensen

Managing Director Investments

Christensen Group

(503) 200-2058

GChristensen@Marcusmillichap.com

Related Reading

The Operational Edge: How Apartment Owners Can Boost NOI Without Raising Rents

Why Portland’s Recovery May Outpace the Sunbelt

2025 Market Outlook: Where Capital Is Flowing Next