Building Permit Costs and Timelines Impact on Portland's Multifamily Development

Portland's multifamily housing development has reached a critical inflection point in 2025, with permit-related costs and extended approval timelines creating substantial barriers to new apartment construction. This research reveals that permit and System Development Charge (SDC) costs now represent approximately 11% of total construction value, while permit approval timelines average 413 days—nearly twice the regional average. The result has been a dramatic 84% decline in permitted multifamily units from the 2022 peak, with only 648 units projected for 2025—the lowest level since 2009. The City of Portland has responded with an aggressive SDC waiver program effective August 15, 2025, through September 30, 2028, potentially saving developers $100 million across 5,000 targeted housing units. However, fundamental timeline inefficiencies and underlying cost structures continue to pose significant challenges for multifamily investors.

Current Market Conditions and Permit Trends

Over the past five years, Portland’s multifamily permitting activity has swung dramatically. After hitting a high point of 4,112 units approved in 2022, activity has since collapsed. By 2024, permits dropped to just 820 units—a 58.9% year-over-year decline—with forecasts for 2025 pointing to an even deeper pullback of 21%, down to only 648 units.

This downturn is far more severe than what’s being seen regionally. Across the broader Portland metro area, multifamily permits are projected to fall 35% through 2025, but within the city limits the drop is closer to 66% relative to production goals. The shortfall is especially stark when compared with Oregon’s statewide objective of adding 36,000 homes annually, underscoring policy concerns about Portland’s lagging contribution.

What makes this trend notable is that it isn’t driven by weak demand. In fact, market conditions showed improvement in Q2 2025: vacancy rates eased to 7.5% and net absorption hit 1,400 units—well above the long-term average of 810 units per quarter. The gap between strong demand and limited supply points to significant development hurdles that continue to hold back new construction.

System Development Charges: The Largest Cost Component

System Development Charges represent the most significant permit-related expense for multifamily developers in Portland. Current SDC rates average approximately $20,000 per unit across four municipal bureaus, though costs can reach $50,000 for larger units with higher infrastructure impacts.

The SDC structure creates challenges for multifamily development due to its flat-fee approach. Transportation SDCs, the largest component at roughly $8,000 per unit, are calculated based on trip generation models that may not fully reflect the reduced per-capita transportation demand typical of urban multifamily housing. Similarly, Parks & Recreation SDCs at $4,500 per unit apply uniformly regardless of proximity to existing park facilities or the actual recreational needs of apartment residents.

Environmental Services SDCs, covering both sanitary sewer and stormwater management, add another $4,000 per unit. These charges are based on plumbing fixture counts and impervious surface area, creating cost structures that can disproportionately impact efficient, higher-density designs. Water SDCs, while the smallest component at $3,500 per unit, are determined by meter size requirements that may not scale proportionally with actual consumption patterns in multifamily buildings.

Permit Timeline Analysis and Regional Comparison

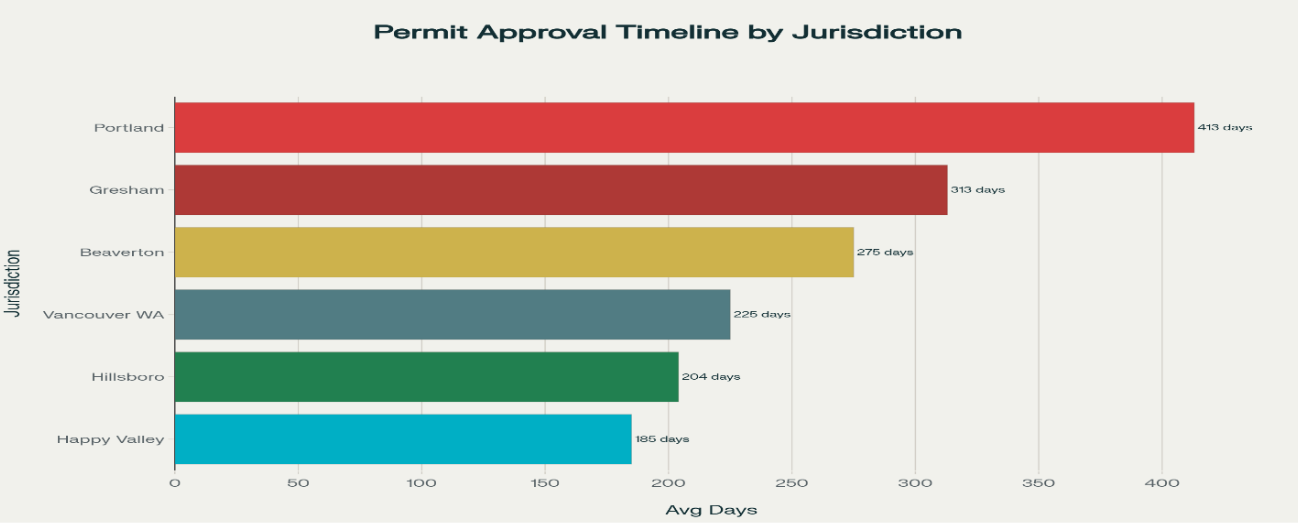

Portland's permit approval process significantly lags behind regional competitors, creating substantial carrying cost burdens for developers. The current average timeline of 413 days from application to permit issuance compares unfavorably to Happy Valley (185 days), Vancouver, WA (225 days), and Hillsboro (204 days).

The extended timeline stems from multiple factors within Portland's review process. Initial screening and setup procedures typically require 15 days, compared to 7 days in best-practice jurisdictions. Plan review, the most time-intensive phase, averages 300 days and often requires multiple correction cycles. This compares to approximately 120 days in more efficient permitting systems. The timeline inefficiencies create substantial financial impacts beyond the direct permit costs. For a typical 100-unit apartment project with $5 million in land value, the extended Portland timeline generates an additional $98,750 in carrying costs compared to a streamlined 176-day process. For larger 200-unit developments, this carrying cost penalty can exceed $197,500—nearly equivalent to the SDC burden for 10 units.

Economic impacts compound during periods of market volatility. Applications submitted during economic downturns historically experience even longer processing times, with permits applied for in 2008 taking an average of 575 days and 2020 applications averaging 500 days. This procyclical pattern exacerbates market cycles and reduces development activity precisely when affordable housing production becomes most critical.

SDC Waiver Program: Immediate Relief with Long-term Questions

Portland's temporary SDC waiver program, effective August 15, 2025, through September 30, 2028, represents the most significant policy intervention to address development cost barriers. The program automatically exempts qualifying residential developments from all SDC payments, with no application required for eligible projects.

The program's financial impact is substantial. Based on the $20,000 average SDC cost per unit and the 5,000-unit target, the initiative represents approximately $100 million in foregone city revenue over three years. This cost will be distributed across city bureaus, with Portland Bureau of Transportation facing an estimated $10 million impact, Parks & Recreation approximately $22.5 million, Environmental Services $20 million, and Water Bureau $17.5 million.

The waiver program design addresses several previous barriers to SDC relief. Unlike the existing affordable housing SDC exemption program, which requires extensive affordability compliance and monitoring, the new program applies automatically to market-rate housing. The program also eliminates the deed restriction requirements previously imposed on ADU SDC waivers, providing greater flexibility for property owners.

However, questions remain about the program's long-term sustainability and effectiveness. The three-year timeline may not align with typical multifamily development cycles, which often require 18-24 months from permit approval to construction completion. Additionally, the program does not address underlying timeline inefficiencies that continue to impose carrying cost burdens and market uncertainty.

Infrastructure funding implications also merit consideration. SDCs exist to ensure that new development contributes proportionally to infrastructure capacity needed to support growth. The temporary suspension of these charges may create deferred infrastructure maintenance and expansion needs, potentially creating future cost pressures for the city's capital improvement programs.

Development Economics and Feasibility Analysis

The current cost and timeline structure creates significant feasibility challenges for multifamily development in Portland. For a typical 50-unit apartment project with a $10 million construction value, permit-related costs approach $1.1 million, representing nearly 11% of total development cost. This percentage is substantially higher than in most comparable markets and can often determine project viability.

The cost structure particularly impacts mid-market and workforce housing development. These projects typically operate with tighter pro formas and less capacity to absorb additional costs compared to luxury developments targeting higher-income renters. The flat-fee SDC structure exacerbates this challenge, as smaller units bear the same per-unit charges as larger, higher-rent apartments.

Carrying costs during the extended permit process create additional strain on project economics. Development financing typically includes acquisition loans with floating interest rates, making extended approval periods particularly expensive during periods of elevated interest rates. The 237-day differential between Portland's timeline and best-practice standards translates to nearly eight additional months of carrying costs.

Market timing risks also increase with longer permit processes. Multifamily markets can shift significantly over 12-18 month periods, potentially altering project feasibility between application submission and permit approval. Developers face uncertainty about market rents, construction costs, and financing availability throughout extended review periods.

Policy Implications and Future Outlook

Portland's current approach combines short-term cost relief through the SDC waiver with ongoing efforts to improve permit processing efficiency. The city's updated permit dashboards, launched in July 2025, provide enhanced transparency into review timelines and may facilitate targeted process improvements.

However, structural challenges remain that require longer-term policy attention. The city's permitting system continues to rely on manual review processes that struggle to scale with application volume. Staffing levels in key review departments have not kept pace with development activity during peak periods, contributing to processing backlogs.

The SDC waiver program's three-year timeline creates policy uncertainty beyond 2028. Without complementary improvements to processing efficiency, the expiration of SDC relief may trigger another development slowdown. The program's success will likely depend on the city's ability to use the temporary relief period to implement lasting process improvements.

State-level housing policy initiatives may also influence Portland's development landscape. Governor Kotek's 36,000 annual unit target and related legislative measures create pressure for improved local permitting processes. State oversight of local housing production may eventually include consequences for jurisdictions that fail to meet housing targets due to permitting inefficiencies.

Construction industry trends suggest continued cost pressures that will make permitting efficiency increasingly important. Labor shortages, material cost volatility, and potential trade policy changes all point toward an environment where development margins remain tight. Efficient permitting processes will become increasingly critical for maintaining development feasibility.

Portland's multifamily sector is charting a course for robust future growth, driven by a market now showing distinct signs of stabilization and a foundation for recovery. Net absorption surged in Q2 2025, vacancy rates declined to near pre-pandemic levels, and rent growth outpaced national averages—reflecting improving fundamentals and resilient demand from Portland’s young, educated population.

The implementation of a three-year System Development Charge (SDC) waiver represents direct, meaningful cost relief for new developments, making the timing highly advantageous for investors ready to activate pipeline projects. Coupled with a renewed push for permit process reforms and strong demand in both urban and suburban submarkets, these factors point toward a unique window of opportunity for those focused on strategic acquisitions and well-located developments. The region’s vibrant culture, economic diversity, and sustained in-migration underpin a promising long-term outlook, as Portland continues to be an attractive destination for millennials and Gen Z renters.

While challenges remain regarding permit timelines and elevated construction costs, Portland’s proactive policy measures, strong occupancy rates (95.5%), rising investment activity, and resilient underlying demand suggest that a new cycle of growth is already forming. Multifamily investors who act decisively—aligning with current incentives, monitoring submarket trends, and leveraging local expertise—are positioned to capitalize on both near-term cost advantages and Portland’s enduring market strengths.